Introduction

Investing in the stock market is a thrilling endeavor, and when it comes to technology stocks, Nvidia has consistently been a hot topic. The question on many investors’ minds is whether Nvidia’s stock will hit the coveted $1,100 mark. In this article, we’ll dive deep into the historical performance, current market analysis, growth factors, potential risks, and investor sentiment surrounding Nvidia. By the end, you’ll have a comprehensive understanding of the factors influencing the $1,100 projection and whether it’s a feasible goal for Nvidia.

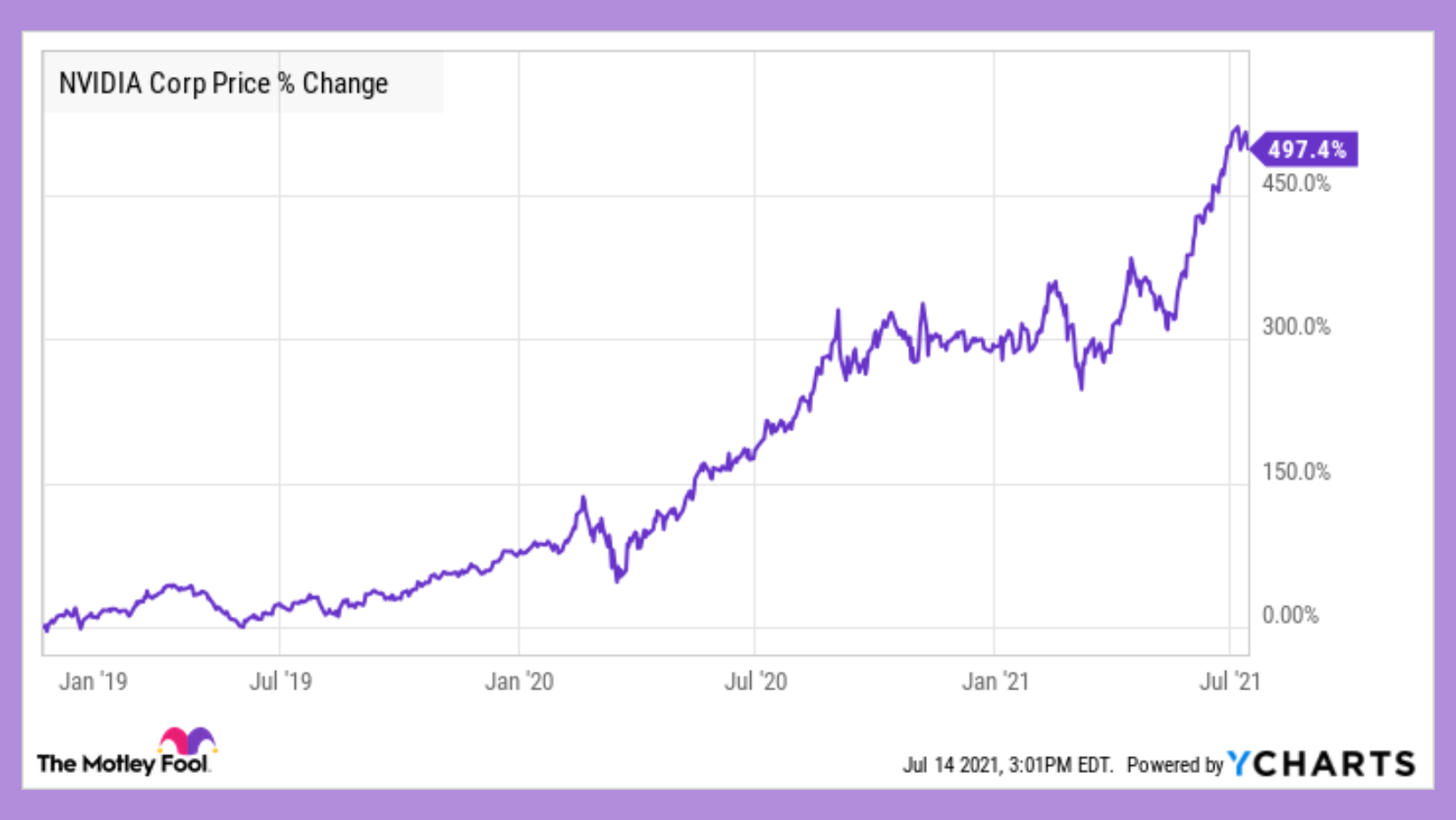

In 2023, one of the most talked-about stocks on Wall Street was semiconductor manufacturer Nvidia (NASDAQ: NVDA), which benefited from the present surge in artificial intelligence. Moreover, it has gotten off to a tremendous start in 2024, which is even more astounding. Shares are up over 55% year-to-date as of this writing, helped along by a significant increase this week when the firm announced a 265% year-over-year gain in fiscal fourth-quarter sales.

The weird thing is that as a consequence of Nvidia’s better-than-expected quarterly performance, more than a dozen analysts have increased their 12-month price targets for the growth stock to levels that are far higher than the current trading price of shares. Actually, a number of analysts now have $1,000 or greater price estimates for the company.

Find out why a few of the most optimistic Nvidia Wall Street analysts are so positive.

How to get $1,000 and some more

Following Nvidia’s most recent earnings release, management’s outlook has been touted by several analysts as a reason to be positive about the company. Revenue for the fiscal first quarter was predicted to be around $24 billion, which is almost $2 billion more than the average analyst prediction.

John Vinh, a KeyBanc analyst, increased the company’s 12-month price estimate from $740 to $1,100. He shared the confidence of analysts at Bernstein and Benchmark who raised their price objective for Nvidia shares to $1,000 after the results announcement due to the company’s tremendous momentum, which was evident in its exponential sales growth in fiscal Q4 and management’s fiscal first-quarter projection.

In addition, Vinh singled out the data center as the source of the company’s soaring revenues. Income from data centers increased by a staggering 409% year over year and 27% sequentially in the fourth fiscal quarter.

Several different sectors are showing interest in Nvidia’s data center solutions, according to CEO Jensen Huang’s remarks in the company’s earnings report for the fiscal fourth quarter. “Our Data Center platform is powered by increasingly diverse drivers: demand for data processing, training, and inference from large cloud-service providers and GPU-specialized ones, as well as from enterprise software and consumer internet companies,” said Jensen. Even the automotive, banking, and healthcare sectors’ demands “are now at the multibillion-dollar level,” he said.

Stock in Nvidia may not be suitable for all investors.

When you consider the stock’s meteoric rise in value during the fiscal fourth quarter and management’s prediction of a $16.8 billion year-over-year gain in sales for the fiscal first quarter, it’s easy to see why investors are so bullish. But does this imply that buyers of the stock at its present price should continue to do so?

The stock should be trading at a premium value since Nvidia’s profits per share in fiscal 2024 soared 586% to $11.93. Further, for a firm with profits expanding at this rate, the present price-to-earnings ratio of 65 really seems fair.

Even while these things help to justify the stock’s present price, investors still need to be wary of one thing: A large portion of the interest in generative AI is fueling the demand for Nvidia’s data center solutions. Not only is the future of this technology very unpredictable, but it is also impossible to foresee how sales will pan out after the initial surge in demand for these items levels down and the sector as a whole develops.

Similarly, rivals in the field may end up being more skilled than anticipated. Wall Street has a history of underestimating competitors. Twenty years ago, few would have predicted that Intel would decline and see its size overtaken by a number of competitors.

There is currently no indication that sales will be declining anytime soon, according to Nvidia’s projection for fiscal Q1 revenue and remarks made by management during the results call about the continued supply constraints of several important products. However, investors need to be cognizant of this risk.

Investors should exercise caution when perusing the optimistic 12-month price estimates for the company, choosing instead to do their own research and keep their focus on the long term. Perhaps the stock is indeed worth the price it is selling at right now. However, if you are uncertain about the future of the firm, it is OK to remain on the sidelines. You have several more stock options to think about.

Is it a good time to put $1,000 into Nvidia?

Do your research before investing in Nvidia.

The expert team at Motley Fool Stock Advisor has just released its list of the top ten stocks that investors should purchase right now, of which Nvidia is not a part. If these 10 companies are any indication, they have the potential to generate enormous profits in the years to come.

Stock Advisor gives investors a simple road map to success by providing them with two new stock recommendations every month, as well as advice on how to construct a portfolio and frequent updates from analysts. Since 2002*, the return of the S&P 500 has been more than quadrupled by the Stock Advisor service.

Starting February 20, 2024, Stock Advisor is back in action.

No stock listed is one in which Daniel Sparks has a stake. His clients may own shares of the aforementioned companies. Nvidia is a stock that The Motley Fool recommends and owns. Among Intel’s many suggested investments, The Motley Fool suggests: Intel has long January 2023 calls for $57.50, long January 2025 calls at $45, and short February 2024 calls worth $47. A disclosure policy is in place at The Motley Fool.

Nvidia Stock: Is $1,100 in Your Future? first appeared in The Motley Fool’s publication.

Conclusion

In conclusion, navigating the world of Nvidia stock involves understanding its past, analyzing the present, and predicting the future. The $1,100 question requires careful consideration of numerous factors.

FAQs

- Factors Contributing to Nvidia’s Stock Growth

Investigate the key factors driving Nvidia’s impressive stock growth over the years.

- Impact of Market Trends on Nvidia’s Performance

Understand how evolving market trends shape the performance of Nvidia’s stock.

- Significant Risks Associated with Investing in Nvidia

Identify and assess the major risks that investors should be aware of when considering Nvidia.

- Distinguishing Nvidia from Competitors

Explore the unique features and strategies that set Nvidia apart from other players in the tech industry.